Home / Blog / Top 6 Home Improvement Retailer Digital Marketing Agencies (2026)

digital marketing

Top 6 Home Improvement Retailer Digital Marketing Agencies (2026)

Published: February 09, 2026

Share on LinkedIn Share on Twitter Share on Facebook Click to print Click to copy url

Contents Overview

Home improvement retail does not follow standard digital marketing playbooks. It operates as a hybrid of project-based buying, local inventory and services, seasonal demand cycles, and offline-heavy revenue. These dynamics fundamentally change how marketing must be planned, executed, and measured.

Unlike traditional e-commerce, customers rarely arrive ready to buy a single product. They plan projects, research options, validate sizing and compatibility, compare fulfillment methods, and often decide whether professional installation is required. Research from Think with Google shows that these journeys are extended, non-linear, and span multiple touchpoints over weeks or months before a purchase is completed — frequently in a physical store.

This complexity is where many agencies fall short. E-commerce agencies tend to optimize for short conversion paths and online-only revenue, while home services agencies focus on lead volume without accounting for inventory, merchandising, or retail margin dynamics.

Key Takeaways

- What’s the #1 reason home improvement retail marketing needs a different agency than “standard ecommerce” or “home services”? Because buyers follow project-based, long, non-linear journeys that blend research + local availability + installation decisions, so agencies must optimize beyond last-click ecommerce and connect digital touchpoints to store visits, calls, and service bookings.

- What capabilities should you require before hiring an agency? Look for strength across (1) paid media + Shopping/PMax feed governance at scale, (2) local inventory/pickup + installation marketing, and (3) attribution infrastructure (POS/CRM, call tracking, offline conversion imports, and longer 60 to 90 day windows) so performance reflects true online-to-offline revenue.

- Which agencies are the top options to consider—and who are they best for? Go Fish Digital (enterprise/national; SEO + content + digital PR), Blue Corona (installation/service-heavy; paid search + call attribution), WebFX (mid-to-large scale; paid media + feeds + analytics), Scorpion (multi-location/service-led; local systems + governance), Hook Agency (specialty/regional; conversion-focused content + trust), and LocaliQ (local reach/visibility; paid distribution + market coverage).

Top Digital Marketing Agencies for Home Improvement Retailers

Not every digital marketing agency is built to support home improvement retail at scale. The agencies highlighted below stand out because they demonstrate experience across project-based buyer journeys, local and service-driven conversion paths, seasonal demand cycles, and blended online-to-offline measurement.

Rather than ranking agencies generically, this section focuses on fit; matching agency strengths to the operating realities of home improvement retailers.

How We Reviewed Our Agency List

Each agency profile follows the same format:

- Best for: The type of retailer the agency is best suited to support.

- Core strengths: Channels or capabilities where the agency consistently performs well.

- Why they fit home improvement retail: How their approach aligns with project-based, omnichannel buying.

This structure allows decision-makers to quickly narrow options based on business model and complexity.

Top Home Improvement Retailer Digital Marketing Agencies (Comparison Table)

| Rank | Agency | Best For | Core Strength |

| #1 | Go Fish Digital | Enterprise & national retailers | SEO, content, digital PR |

| #2 | Blue Corona | Product + installation retailers | Paid search, call attribution |

| #3 | WebFX | Mid-to-large retailers | Paid media, feeds, analytics |

| #4 | Scorpion | Multi-location service-led retail | Local execution, governance |

| #5 | Hook Agency | Specialty & regional retailers | Conversion-focused content |

| #6 | LocaliQ | Market-level visibility | Local reach, paid distribution |

Last fact checked: Agencies were reviewed on February 9th, 2026.

1. Go Fish Digital

Best for: Enterprise and national home improvement retailers

Core strengths: Enterprise SEO, content strategy, digital PR, analytics

Go Fish Digital specializes in capturing early-stage project research demand and translating it into measurable retail performance. Their strength lies in building scalable SEO and content programs that address how-to, comparison, and compatibility queries; key entry points for home improvement buyers.

They are well-suited for retailers with large catalogs, multiple categories, and national footprints where organic visibility plays a major role in influencing both online and in-store revenue. Their work aligns closely with research from Think with Google, which highlights the importance of educational content throughout extended buyer journeys.

2. Blue Corona

Best for: Retailers with strong installation or service components

Core strengths: Paid search, local SEO, call tracking, service attribution

Blue Corona’s approach is particularly effective for retailers where calls, appointments, and installation bookings represent high-value conversions. Their experience aligns with Google Ads guidance on store visits and offline conversion tracking, making them a strong fit for businesses that rely on local execution.

They perform best in environments where product marketing and service promotion must work together, and where offline outcomes materially affect revenue.

3. WebFX

Best for: Mid-to-large home improvement retailers seeking scale

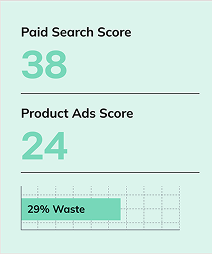

Core strengths: Paid media, Shopping feeds, SEO, reporting infrastructure

WebFX is known for operational scale and process discipline. They are well-positioned to manage large product catalogs, frequent promotions, and multi-channel programs that include Shopping and Performance Max.

For retailers navigating seasonal demand shifts and catalog complexity, challenges frequently highlighted in NRF retail reporting, WebFX provides structure and repeatability.

4. Scorpion

Best for: Multi-location retailers with service-led models

Core strengths: Local marketing systems, paid media, franchise-style governance

Scorpion’s platform-driven approach works well for retailers with many locations and a strong service component. Their systems support consistent execution while allowing for local optimization, an important capability in categories where store-level accuracy affects conversion.

Their strengths align with Google’s local marketing frameworks, particularly where store visits and calls are primary success metrics.

5. Hook Agency

Best for: Specialty and regional home improvement retailers

Core strengths: Conversion-focused content, SEO, trust-driven messaging

Hook Agency emphasizes clarity, education, and trust; factors that play an outsized role in higher-consideration home improvement purchases. Their content strategies align well with project-based buying behavior and long research cycles.

They are often a strong fit for regional chains competing against larger national brands on expertise and customer confidence rather than scale alone.

6. LocaliQ

Best for: Retailers prioritizing local reach and visibility

Core strengths: Local paid media, directory presence, market-level distribution

LocaliQ excels at driving broad local visibility, particularly for retailers focused on store traffic and awareness. Their approach emphasizes reach and consistency across markets rather than deep customization or advanced attribution.

They are best suited for retailers whose primary objective is market-level saturation and foot traffic growth.

How to Choose the Right Agency From This List

There is no universally “best” agency for home improvement retail. The right partner depends on:

- Whether revenue is driven primarily by products, services, or both

- The size and complexity of the catalog

- The number of store locations

- The importance of offline attribution and blended measurement

Use the evaluation criteria in the previous section to identify agencies whose strengths align with your specific operating model, not just your budget or brand size.

Why Home Improvement Retail Marketing Is Different From E-commerce & Home Services

Home improvement retail marketing differs from nearly every other retail category because success is driven by projects, places, and people, not just products. Buyers move through longer decision cycles, interact with both digital and physical touchpoints, and often complete transactions offline after extensive online research. Agencies that do not account for this complexity consistently misallocate budget, misread performance, and undervalue high-impact channels.

Project-Based Buyer Journeys (Not SKU-Driven)

Home improvement customers do not shop one product at a time;they plan projects. A single purchase decision often spans multiple categories, brands, and research sessions as buyers move from planning to validation before committing.

Research from Think with Google shows that shoppers cycle repeatedly between exploration and evaluation phases, consuming educational content, product comparisons, reviews, and local availability checks across devices before purchasing. These journeys are non-linear and frequently extend over weeks or months, especially for higher-consideration projects.

Key implications for marketing:

- Demand begins with education, not product pages

- Multiple sessions and channels influence a single conversion

- Attribution windows must extend well beyond standard e-commerce models

Agencies that optimize only for last-click or single-SKU performance fail to capture the true value of early-stage research and planning behavior.

Required visual:

Diagram illustrating the project-based journey: Planning → Research → Validation → Purchase → Install

Local Inventory, Pickup & Installation Drive Conversion

Home improvement retail is inseparable from local execution. Store pickup, delivery, installation, and pro services are not add-ons; they are often decisive conversion factors.

According to Google Ads documentation, store visits, calls, and local inventory interactions are critical performance signals for multi-location retailers, particularly in categories where customers want immediate availability or professional installation. Local inventory ads drive 21% increase in store visits and 9% increase in online conversions. This influences both store traffic and downstream revenue.

In this category:

- Calls and appointments frequently represent higher-value conversions than online checkouts

- Installation and delivery services materially impact close rates

- Store-level accuracy directly affects digital performance

Simplified conversion model:

| Function | Primary Channel | Conversion Signal |

| Store pickup | Local inventory ads | Pickup completed |

| Installation | Local PPC & landing pages | Booking |

| Pro services | B2B content & search | Account signup |

Agencies must be able to route digital demand into local stores and service teams;not just ecommerce carts.

Seasonality, Inventory & Promotion Volatility

Home improvement demand is highly seasonal and often weather-driven. Industry reporting from the National Retail Federation (NRF) consistently shows that a disproportionate share of annual home improvement revenue is concentrated in peak seasonal windows, particularly spring and early summer.

This creates unique marketing challenges:

- Budget must scale rapidly during peak demand

- Inventory availability changes by region

- Promotional timing must align precisely with merchandising and supply

Paid media success in this environment depends on promo governance, feed accuracy, and agile budget allocation. Agencies that cannot manage real-time inventory and promotional volatility risk wasting spend or driving demand that cannot be fulfilled.

Optional visual:

Seasonal demand timeline showing category shifts across Q1–Q4

Why Online Research Drives Offline Revenue in Home Improvement

Despite digital’s influence, most home improvement revenue still closes in physical stores. Both Google and NRF research show that traditional ecommerce attribution models significantly underreport performance in categories where online research drives offline conversion.

Last-click ecommerce metrics fail to capture:

- Store visits influenced by paid search and SEO

- Calls to local locations

- Installation and service bookings

- In-store purchases following digital research

Despite the growth of e-commerce, offline sales still represent more than 93% of total U.S. retail revenue. For home improvement, where purchases frequently involve local inventory, fulfillment, and installation, the disconnect between online signals and offline revenue is even more pronounced. As a result, blended measurement is mandatory. Agencies must connect digital touchpoints to offline outcomes using store visit data, call tracking, service attribution, and POS integrations. Without this, marketing programs appear less effective than they truly are, and investment decisions suffer.

Core Capabilities a Home Improvement Retail Agency Must Have

Not every agency that works with retailers is equipped to handle home improvement. Success in this category requires capabilities that account for large catalogs, local execution, service revenue, and offline conversion paths;all operating simultaneously.

The agencies that perform best here share a common foundation: they treat home improvement retail as an omnichannel, project-driven system, not a set of isolated campaigns.

Paid Media & Feed Management at Retail Scale

Paid media is often the primary growth lever for home improvement retailers, but it is also one of the most operationally complex. Agencies must manage thousands of SKUs, frequent promotions, regional inventory differences, and multiple fulfillment options while maintaining efficiency.

Google’s product documentation around Shopping, Performance Max, offline conversion imports, and local inventory ads makes it clear that retail performance depends on accurate feeds, real-time availability, and local extensions;especially for multi-location businesses.

Strong agencies demonstrate:

- Expertise in Google Shopping and Performance Max for large catalogs

- Inventory-aware bidding that adapts to availability and demand

- Promo governance to ensure sales launch and end cleanly

- ROAS targets that account for margin differences across categories

Core paid media requirements:

| Capability | Why It Matters |

| Feed automation | Supports large SKU counts |

| Promo rules | Maintains sale velocity |

| Local extensions | Drives store conversion |

In home improvement retail, paid media performance is inseparable from merchandising and supply realities.

Content & SEO for Project-Based Research Journeys

Content is not a top-of-funnel “nice to have” in home improvement;it is a core revenue driver. Buyers actively seek guidance before committing, especially for projects that involve sizing, compatibility, or installation decisions.

Research from Think with Google consistently shows that shoppers rely on educational content, comparisons, and validation signals during extended decision journeys. This makes content strategy foundational, not supplemental.

Effective agencies build content around:

- How-to and project guides

- Sizing, fit, and compatibility explanations

- Product comparisons that reduce risk

- Installation-focused content that routes to services

To perform well in generative and AI-driven search, this content must be:

- Clearly structured and fact-dense

- Easy to extract and cite

- Closely connected to product and service conversion paths

Content-to-outcome alignment:

| Content Type | Intent | Outcome |

| How-to | Research | Product discovery |

| Sizing | Validation | Add to cart |

| Install guides | Service | Booking |

Agencies that produce content without a clear path to commerce leave revenue on the table.

Local Marketing & Store-Level Execution

Home improvement retailers win or lose at the local level. Store accuracy, availability, and services directly affect conversion rates, particularly for customers who want products immediately or require professional installation.

According to Google Ads guidance on store visits and local inventory, retailers that align digital campaigns with store-level execution are better positioned to capture offline demand.

Agencies must be able to support:

- Google Business Profile management at scale

- Store-specific landing pages with inventory and services

- Local PPC and inventory-driven ad formats

- Market-level and store-level performance reporting

Without strong local execution, even the best national campaigns underperform.

Attribution Infrastructure for Store Visits, Calls & Sales

Measurement is where many agencies fail home improvement retailers. Because revenue often closes offline, accurate attribution requires infrastructure that extends beyond standard e-commerce tracking.

Google’s documentation on offline conversion imports and store sales measurement makes it clear that connecting digital interactions to real-world outcomes is both possible and necessary.

Capable agencies support:

- Call tracking tied to local locations

- Store visit and service booking attribution

- POS and CRM integrations

- Extended attribution windows (60–90 days)

Blended measurement, connecting online research to offline revenue, is not optional in this category. It is the only way to understand true performance and make confident investment decisions.

How to Evaluate Digital Marketing Agencies for Home Improvement Retail

Once you understand the capabilities required to succeed in home improvement retail, the next step is determining which agencies can actually deliver them. Many agencies claim retail or home services experience, but far fewer can demonstrate success across project-based buying, local execution, and offline revenue measurement.

The goal of evaluation is not to find a generalist;it’s to identify a partner that understands how products, services, stores, and seasons work together to drive revenue.

Home Improvement Retail Experience Checklist

Category experience matters more in home improvement than in most retail verticals. The learning curve is steep, and mistakes are costly during peak seasonal windows.

Agencies should be able to demonstrate:

- Active or recent home improvement retail clients

- Experience supporting multi-location retailers

- Proven work with large product catalogs

- Clear examples of offline or in-store attribution, not just ecommerce ROAS

Strong signals of fit include case studies that reference store visits, service bookings, or blended revenue; not just online transactions. Agencies that cannot articulate how their work influenced physical retail outcomes are unlikely to perform well in this category.

Technical & Data Capability Validation

Home improvement retail requires deeper technical integration than standard e-commerce. Agencies should clearly explain how their systems connect media performance to real-world outcomes.

Minimum technical requirements:

| System | Required |

| Merchant Center | Yes |

| POS integration | Yes |

| Call tracking | Yes |

| CRM / bookings | Yes |

Google’s documentation on offline conversion imports, store visits, and local inventory ads underscores the importance of these systems for multi-location retailers. Without them, performance reporting will be incomplete and optimization decisions unreliable.

Ask agencies to show:

- Sample reporting dashboards with store-level visibility

- How offline conversions are imported and used for optimization

- Attribution windows aligned to long consideration cycles

Content, Creative & Planning Fit

Because demand in home improvement retail starts with education, content quality is a strong predictor of long-term success.

Agencies should demonstrate:

- Project-based messaging rather than SKU-only promotion

- Seasonal planning processes tied to merchandising calendars

- Experience with video and user-generated content

- Ability to connect content directly to product and service conversion paths

Creative that ignores seasonality, installation considerations, or real-world usage may look polished but rarely performs.

The strongest agencies combine strategic planning, content depth, and execution discipline, allowing them to scale during peak demand without sacrificing relevance or measurement accuracy.

Common Challenges (and What the Right Agencies Do)

Even sophisticated home improvement retailers run into structural challenges that limit performance if agencies aren’t equipped to handle category-specific complexity. These issues are not execution errors; they’re inherent to how home improvement retail operates. The difference is whether an agency anticipates them or reacts too late.

Large SKU & Feed Complexity

Home improvement retailers often manage thousands to tens of thousands of SKUs, with frequent pricing changes, regional availability differences, and seasonal assortment shifts. This creates constant pressure on Shopping feeds and Performance Max campaigns.

The right agencies:

- Use feed automation and rules-based logic rather than manual updates

- Segment products by category, margin, and seasonality

- Prevent spending on out-of-stock or low-availability items

- Coordinate closely with merchandising and inventory teams

Google’s documentation around Merchant Center, local inventory ads, and offline measurement makes clear that feed accuracy is foundational to retail performance, not a back-end task.

Proving In-Store ROI

One of the most persistent challenges in home improvement retail is justifying digital investment when a majority of revenue is closed offline.

Research and guidance from Google and the National Retail Federation consistently highlight the attribution gap between online research and in-store purchase behavior. When agencies rely solely on e-commerce transactions, they dramatically underreport true impact.

The right agencies:

- Treat store visits, calls, and service bookings as primary conversions

- Import offline sales and lead data into analytics platforms

- Report blended performance, not last-click ecommerce only

Without this approach, marketing appears inefficient, even when it is driving meaningful store revenue.

Seasonal Budget Swings

Home improvement demand is uneven across the year, with a disproportionate share of revenue occurring in spring and early summer. NRF reporting shows how seasonal concentration affects categories like building materials, lawn and garden, and outdoor living.

The right agencies:

- Plan seasonal campaigns 60–90 days in advance

- Pre-build creative, landing pages, and feed logic

- Reallocate budgets by category and region as demand shifts

- Avoid reactive budget cuts that undermine peak performance

Seasonality isn’t a surprise in this category; it’s a planning requirement.

Product vs. Service Prioritization

Many home improvement retailers generate revenue from both products and services, such as installation, delivery, or pro programs. Treating these as a single conversion type often leads to misaligned messaging and poor performance.

The right agencies:

- Separate product and service campaigns structurally

- Use service-specific landing pages and messaging

- Measure service bookings independently from product sales

- Optimize for lifetime value, not just transaction value

Agencies that understand how services amplify retail revenue consistently outperform those that optimize for product sales alone.

Pricing & Engagement Models

Pricing for home improvement retail marketing reflects the category’s complexity. Programs typically span paid media, feeds, content, local execution, and offline attribution, which makes ongoing retainers the most common engagement model. Project-only work is rarely sufficient for sustained performance, especially through seasonal peaks.

Typical Monthly Ranges

| Retail Size | Monthly Range |

| Regional | $5k–$15k |

| Mid-market | $15k–$40k |

| Enterprise | $40k–$100k+ |

Regional retailers usually engage agencies for paid media management, basic feed support, and limited content or SEO.

Mid-market chains require omnichannel execution, seasonal planning, local marketing, and offline measurement.

Enterprise retailers typically need dedicated teams, advanced feed governance, multi-location reporting, and custom attribution models.

Some agencies offer hybrid or performance-based structures, combining a base retainer with incentives tied to revenue, store visits, or service bookings. In home improvement, these models only work when offline conversions are included; otherwise, performance is misrepresented.

The key is not finding the lowest fee, but ensuring the agency has sufficient resources to manage seasonality, scale, and measurement without cutting corners.

Digital Marketing KPIs That Actually Matter in Home Improvement Retail

Measuring performance in home improvement retail requires moving beyond standard e-commerce KPIs. Because buyer journeys are long, project-based, and frequently end in-store or through services, the most meaningful metrics reflect blended, omnichannel outcomes, not just online transactions.

The KPIs below are best viewed in four groups.

E-commerce Performance

These metrics still matter, but only when interpreted alongside offline impact.

Key indicators:

- ROAS (Return on Ad Spend): Should be evaluated by category and margin, not as a blended average

- Conversion Rate: Useful for identifying friction, especially around delivery and pickup options

- Average Order Value (AOV): Often increases when projects are bundled rather than single SKUs

- Cart Abandonment Rate: Can signal inventory, fulfillment, or pricing issues

Best practice: Treat ecommerce KPIs as directional signals, not definitive measures of success.

In-Store & Local Impact

For most home improvement retailers, these metrics represent the true revenue outcome.

Key indicators:

- Store Visits Influenced by Digital: Measures online-to-offline lift

- Call Volume and Quality: Calls to stores or service teams often indicate high intent

- In-Store Promotion Redemptions: Direct link between digital campaigns and physical sales

- Market-Level Performance Lift: Performance by region rather than site-wide averages

Google and NRF research consistently show that online research drives in-store purchase behavior in home improvement, making these KPIs essential for accurate performance evaluation.

Services & Installation Metrics

Services often carry higher margins and stronger lifetime value than one-time product purchases.

Key indicators:

- Service Booking Conversion Rate: From paid search, local pages, or content

- Cost per Booking: Compared against service margin

- Appointment Completion Rate: Indicates lead quality, not just volume

- Revenue per Service Customer: Measures downstream value

Agencies that track service performance separately from product sales are better positioned to optimize for long-term growth.

Content & Research Influence

Because education precedes conversion, content KPIs play a meaningful role in forecasting demand.

Key indicators:

- Organic Traffic to How-To and Project Content

- Engagement Metrics: Time on page and scroll depth for educational content

- Assisted Conversions: Content’s role in downstream product or service sales

- AI Visibility: Inclusion in generative search results for research-driven queries

According to Think with Google, research-heavy content shapes decisions long before purchase, making these metrics critical even when they don’t convert immediately.

Taken together, these KPIs provide a more accurate picture of performance than ecommerce metrics alone. The most effective agencies optimize toward total business impact, not just what’s easiest to measure.

Common Questions

Questions and answers from our experts:

What makes home improvement retail marketing different from standard e-commerce?

Home improvement retail marketing is driven by project-based buying, long research cycles, and offline conversion paths. Customers research how-to content, sizing, compatibility, and installation options online, but often complete purchases in-store or through service bookings. This makes local execution, services, and offline attribution central to performance; unlike standard e-commerce, which is typically optimized around short, online-only conversion paths.

How do agencies measure in-store conversions from digital marketing?

Agencies measure in-store impact using a combination of store visit tracking, call tracking, service booking attribution, and offline conversion imports. Google’s offline conversion and store visit measurement capabilities allow retailers to connect paid search and SEO activity to physical store outcomes, including purchases that occur days or weeks after online research.

What is a realistic digital marketing budget for home improvement retailers?

Most home improvement retailers invest 3–7% of annual revenue in marketing, with 40–60% allocated to digital channels. Agency fees typically scale with complexity and media spend, especially when paid media, feeds, content, local execution, and attribution infrastructure are involved.

Should home improvement retailers prioritize paid media or SEO?

Both are essential and serve different roles. Paid media captures high-intent demand for products, pickup, and services, while SEO and content marketing capture early-stage project research that shapes decisions long before purchase. Research from Think with Google shows that educational content heavily influences conversion paths, making SEO critical for long-term growth.

How long does it take to see results from home improvement retail marketing?

Paid media programs typically show measurable results within 30 to 60 days, once campaigns and feeds are optimized. SEO and content programs generally require 3 to 6 months to demonstrate meaningful impact. Reliable online-to-offline attribution often takes 90 days or more as sufficient data accumulates across longer buyer journeys.

What integrations are required to market home improvement retail effectively?

Effective programs typically require Google Merchant Center, POS integration, call tracking, CRM or service booking platforms, and GA4 with offline conversion imports. These integrations allow agencies to measure store visits, calls, service bookings, and in-store revenue influenced by digital campaigns.

Why do last-click ecommerce metrics underrepresent performance in this category?

Because most home improvement purchases still close offline, last-click ecommerce models ignore store visits, calls, and service revenue driven by digital research. Both Google and the National Retail Federation research show that relying solely on online transactions significantly underreports true marketing impact in store-driven retail categories.

About Kimberly Anderson-Mutch

MORE TO EXPLORE

Related Insights

More advice and inspiration from our blog

Navigating the Future of Media: Key Themes from the 2025 Digiday Programmatic Marketing Summit

At the 2025 Digiday Programmatic Marketing Summit, one theme kept surfacing:...

Serena Taki| February 02, 2026

What is a "tagline" and how does it differ from a...

Jenny Frey| January 30, 2026

Gen Z, Doom Spending, & Higher Education

Colleges and universities need to understand Gen Z's beliefs and expectations...

Alex Giroux| January 30, 2026