Home / Blog / Enterprise Shoppable Video: The Large Retailer Operating Model (Creators, Formats, Measurement)

Shoppable Video

Enterprise Shoppable Video: The Large Retailer Operating Model (Creators, Formats, Measurement)

Published: February 19, 2026

Share on LinkedIn Share on Twitter Share on Facebook Click to print Click to copy url

Contents Overview

Enterprise retailers in Home + DIY face a structural conversion challenge: complex purchases require confidence before commitment. PDP images, specs, and reviews rarely resolve the questions that actually block conversion, installation feasibility, fit/compatibility, and real-world performance.

According to research by Ghost, “91% of shoppers say they want more video from brands.” And “89% of shoppers say that they’ve been convinced to buy a product after watching a video.” Shoppable video, when implemented as commerce infrastructure rather than a social experiment, becomes a scalable confidence engine embedded inside the buying journey.

This guide outlines the operating model enterprise retailers need to deploy shoppable video across thousands (or millions) of SKUs without creating creative fragmentation, attribution blind spots, or catalog integrity failures.

Key Takeaways

- Is shoppable video just a social commerce trend? No, at enterprise scale it’s a catalog-connected commerce interface embedded on PDPs, PLPs, and project pages, with SKU/variant, price, inventory, and cart actions inside the player.

- Why does shoppable video matter more for DIY than other retail categories? Because DIY purchases are friction-heavy. Conversion is blocked by four confidence gaps: capability (“Can I do this?”), compatibility (“Will this fit?”), performance (“Is this strong enough?”), and commitment (“What if I regret this?”). Video resolves these gaps by demonstrating execution, not describing features. In high-AOV categories, eliminating uncertainty has a larger revenue impact than increasing traffic.

- Do we need premium video for every SKU? No. Enterprise impact comes from coverage strategy, not creative perfection. A structured tier model (Hero SKUs, Core SKUs, Long-Tail SKUs) allocates production investment proportionally to revenue concentration. The KPI is video coverage of revenue-driving SKUs, not total video views.

- Can influencer campaigns accomplish this? Not sustainably. Campaigns are episodic. Enterprise retailers require a distributed expertise infrastructure: internal store associates, professional contractors, category specialists, and lifestyle DIY creators operating under long-term usage and amplification rights. This ensures continuous category-level content production aligned with merchandising priorities.

- How should we measure performance? Don’t judge it by clicks. Track iROAS (holdout-tested lift), view-through revenue, AOV lift, time-to-purchase compression, and return-rate suppression, then reallocate spend to formats/creators that move those together.

What Shoppable Video Actually Is (At Enterprise Scale)

Most industry definitions describe shoppable video as “interactive video with product hotspots.” That is tactically accurate but strategically shallow. At enterprise scale, shoppable video functions as a real-time, catalog-synced commerce layer embedded inside media, a conversion interface embedded inside the commerce stack, not a passive media asset..

At enterprise scale, it must be integrated with core commerce systems (PIM, inventory, cart/checkout, and asset management) to maintain data integrity across thousands of SKUs.

It connects five things that determine whether the experience converts, or breaks trust:

- SKU-level metadata from PIM: This ensures that technical specifications and dimensions are accurate, serving as the “single source of truth” for the video player.

- Variant selection logic: Advanced players handle complex logic (size, finish, configuration) directly within the video overlay, preventing the user from needing to leave the experience to select specific attributes.

- Live pricing and Inventory APIs: Enterprise solutions utilize server-to-server connections and “delta feeds” to ensure that if a price changes or stock runs out in the ERP, the video overlay updates instantly to prevent customer frustration.

- Add-to-cart or “Add All to Cart” bundle logic: This feature reduces friction by allowing users to purchase all components of a project (e.g., a sink, faucet, and installation kit) in a single click, collapsing the funnel from discovery to transaction.

- First-party behavioral data capture: Unlike social platforms where data is walled off, onsite enterprise players capture granular intent signals, such as which specific parts of a tutorial are rewatched or where drop-offs occur, fueling “incrementality” measurement and future merchandising strategies.

In short: shoppable video is only ‘shoppable’ when the player behaves like a first-class ecommerce surface, accurate SKU/variant, current price, current inventory, and a frictionless path to cart.

Why Shoppable Video Is Becoming Critical for High-Consideration Categories

Consumers spend an average of 100 minutes per day watching online video. Even in a social-first world, ecommerce sites remain the primary transaction channel, 94% of online shopping transactions happen on ecommerce sites vs. 6% on social media.

DIY and high-consideration categories introduce friction that static content cannot resolve. In these categories, the primary barrier isn’t interest, it’s uncertainty about execution, fit, and performance. These friction types compound as Average Order Value (AOV) increases.

| Friction Type | Core Customer Question | Enterprise Risk | How Video Resolves It |

| Capability Gap | “Can I actually do this project?” | Abandonment | Step-by-step install walkthroughs: These function as digital project partners, breaking complex tasks into manageable segments to prove feasibility. |

| Compatibility Gap | “Will this fit/work here?” | Returns | Near-term: in-context demos and clearer compatibility explainers reduce uncertainty. Future-state: assistants layered into the player can answer compatibility questions during playback (e.g., ‘Will this fit my cabinet?’). |

| Performance Gap | “Is this powerful enough?” | Comparison paralysis | Real-use demos & “Pro” Validation: Leveraging professional contractors to stress-test products provides the technical credibility and social proof required for B2B and high-end tools. |

| Commitment Gap | “What if I regret this?” | Delayed purchase | Outcome visualization + bundles: “Before and After” formats leverage the narrative arc of challenge and relief, providing a concrete blueprint for the consumer’s aspirations. |

High-consideration products require proof of execution. Video supplies that proof at scale, effectively recreating the guidance of a knowledgeable store associate within the digital environment.

Why Home + DIY Requires a Different Operating Model

Unlike impulse categories, Home + DIY operates under customer risk. Video’s job shifts from generating hype to reducing costly uncertainty. Uncertainty regarding product scale, functional integration, or the consumer’s ability to execute a complex installation.

Consequently, the video strategy shifts from generating “hype” to providing “proof.” Economic realities dictate a tiered operating model that prioritizes validation over entertainment.

| DIY Reality | | What It Changes | What the Program Must Operationalize |

| High AOV | Education depth justifies higher production investment | Tiered Content Production: Retailers like Lowe’s utilize a tiered model: “Tier 1” high-margin appliances receive professionally produced 90-second buying guides, while “Tier 3” products utilize scalable “point-and-shoot” videos to ensure coverage without exhausting budgets. |

| High Return Rates | Instruction reduces post-purchase regret | Expectation Management via Unboxing: Unboxing videos are critical here, not for hype, but to align customer expectations with reality regarding packaging and parts, significantly reducing “item not as described” returns. |

| Multi-SKU Projects | Video enables “shop the project” bundling | Project Planning Integration: Beyond simple “add-to-cart,” video must integrate with “Project Planning Tools” (like Home Depot’s Pro tools) that allow users to purchase entire material lists (lumber, fasteners, and finish) triggered by a single instructional video. |

| Long Sales Cycles | View-through attribution required | Adopting ROMO & Incrementality: Because the purchase cycle can span weeks, retailers must move beyond “last-click” metrics to “Return on Marketing Objective” (ROMO) and incrementality testing, measuring the long-term lift in brand preference and offline sales generated by digital viewing. |

| Skill-Dependent Installation | Instructional formats drive conversion | The “Orange Apron” Strategy: Leveraging internal Subject Matter Experts (SMEs) and professional contractors (“Pros”) to host content creates necessary technical credibility that lifestyle influencers cannot provide, bridging the gap between inspiration and execution. |

Video in this context is not about engagement, it is about risk mitigation. It functions as a digital store associate, answering specific technical questions (e.g., “Will this dishwasher fit my cabinet?”) to prevent abandonment and B2B jobsite delays.

Reframing the Buyer Journey: The Confidence Curve

Traditional funnel language (Awareness → Consideration → Conversion) obscures the real barrier in high-consideration categories like Home and DIY: confidence. The primary obstacle is not a lack of interest, but a “confidence gap”, uncertainty regarding feasibility, compatibility, or execution skills.

Instead of a linear funnel, DIY shoppers move through a Confidence Curve, where video functions as a specific risk-mitigation tool at each stage.

| Stage of Curve | Core Customer Question | The “Friction” Barrier | Video Solution & Format |

| 1. Inspiration Gap | “Is this actually possible for my home?” | Visualization Risk: Static “Before” and “After” photos hide the labor in between, making the project feel unattainable. | Narrative “Before & After” Clips: Video provides a narrative arc of “challenge and relief”. Short-form vertical video (Reels/TikTok) serves as the lead magnet, showing the transformation process to validate the consumer’s aspirations. |

| 2. Capability Gap | “Can I actually execute this project?” | The Skill Barrier: The customer fears they lack the technical expertise (e.g., electrical wiring, laying tile) to complete the task. | The “Digital Project Partner”: Step-by-step instructional videos break complex tasks into manageable chunks. Retailers must leverage “Internal Subject Matter Experts” (e.g., Home Depot’s “Orange Apron”) or professional contractors to provide the technical credibility lifestyle influencers lack. |

| 3. Compatibility Gap | “Will this fit and work in my specific space?” | Integration Anxiety: Uncertainty about dimensions, voltage, or aesthetic fit leads to decision paralysis and returns. | Near-term: high-fidelity demos + compatibility explainers reduce integration anxiety. Future-state: AI assistants embedded in the player can answer fit/compatibility questions during playback; spatial/AR integrations can support renovation ‘try-on’ experiences. |

| 4. Commitment Gap | “What if I buy the wrong parts or regret the cost?” | Logistical Fear: The anxiety of missing components or overspending causes cart abandonment. | “Shop the Project” Bundling: Integration with Project Planning Tools allows video to trigger whole-project purchasing. Instead of adding one item, the video populates the cart with the entire material list (lumber, fasteners, finish). UGC and testimonials provide final social proof to validate the decision. |

Where Shoppable Video Creates the Most Enterprise Value

Not all SKUs benefit equally from video investment. While lifestyle imagery drives clicks, the highest Enterprise ROI comes from categories with high “friction density”, products where the customer faces a “confidence gap” regarding installation, compatibility, or performance.

In these categories, video moves beyond marketing to become a “digital project partner,” effectively recreating the guidance of a store associate to mitigate risk and close the sale.

| Category Type | Why It’s High-Friction | What Video Must Prove |

| Installation-Required | High | The “Digital Project Partner”: Step-by-step “how-to” videos break complex tasks into manageable chunks. Retailers like Lowe’s utilize “Tier 2” production for these, focusing on specific feature demonstrations to prove feasibility to the novice DIYer. |

| Performance-Based | Medium–High | Validation via Stress-Testing: For tools and appliances, static specs are insufficient. Video provides “proof of execution” through close-ups of mechanical parts and usage demos by “Pros” or internal SMEs (Subject Matter Experts) to establish technical credibility. |

| Visual Transformation | Medium | The “Before & After” Arc: These videos leverage the psychological narrative of “challenge and relief.” They visualize the potential of a space (e.g., a kitchen remodel), offering a concrete blueprint for the consumer’s aspirations rather than just product shots. |

| Project Bundles | High | “Shop the Project” Integration: Instead of selling a single SKU, video triggers the purchase of an entire material list. Tools like Home Depot’s “Project Planning Tool” integrate with video to allow pros to buy lumber, fasteners, and finish in one transaction. |

The priority is not aesthetic categories, it is friction-heavy categories. Success in high-consideration sectors is defined by the ability to turn a moment of digital inspiration into a measurably successful project, using video to eliminate the “confidence gap” that stalls transactions.

The Enterprise Shoppable Video Operating Model

Scaling shoppable video requires a shift from “artisanal” content creation to a programmatic operating model. Retailers must align five operational layers to support high-volume transaction velocity.

1. Content Architecture: The Tiered Production Matrix

Enterprises cannot afford agency-level production for every SKU. Success relies on a Tiered Production Model that balances cost with coverage.

| Tier | Content Type | Target SKU Type | Production Method |

| Tier 1 | Buying Guides | High-Margin / High-AOV (e.g., Appliances) | Studio-produced, 90-second deep dives. High budget justified by margin. |

| Tier 2 | Feature Demos | Mid-Tier / Technical Items (e.g., Power Tools) | Agile content produced by internal SMEs (e.g., “Orange Apron” experts) focusing on utility. |

| Tier 3 | Point & Shoot | Long-Tail / Volume (e.g., Hardware) | Scalable, mobile-shot video or AI-generated clips to ensure catalog coverage. |

2. Creator Supply Chain: The “Expert” Mix

Unlike fashion, DIY credibility comes from doing, not just styling. The supply chain must blend three distinct cohorts.

- Internal SMEs (Subject Matter Experts): Store associates (e.g., Home Depot’s “Orange Apron” staff) who provide technical credibility and humanize the brand.

- Professional Contractors (“Pros”): High-level creators who stress-test products. Their endorsement is critical for B2B validation.

- Lifestyle Influencers: Focus on the narrative arc of “challenge and relief” (Before/After) to drive top-of-funnel inspiration.

3. Technical Infrastructure: PIM + DAM Integration

To scale, the “shoppability” must be automated. This requires the marriage of Product Information Management (PIM) and Digital Asset Management (DAM) systems.

| System | Role in Video Commerce | Critical Function |

| PIM | Data Source | Provides structured metadata (SKUs, pricing, specs) to the video player. |

| DAM | Asset Hub | Manages video rights, versions, and expirations to ensure brand safety. |

| AI Tagging | Automation | Object recognition identifies products in video frames and auto-tags SKUs, removing manual labor. |

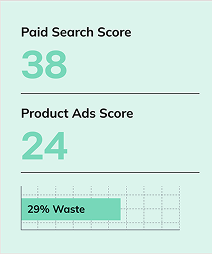

H3: 4. Measurement: Moving to Causality

Enterprise retailers are moving beyond “views” to Incrementality and ROMO (Return on Marketing Objective).

- Incrementality Testing: Comparing a “test group” exposed to shoppable video against a “control group” to answer: “Did this video generate a sale that otherwise would not have happened?”.

- View-Through Attribution: Crediting the video for sales that occur days later, recognizing the long research cycle of high-consideration purchases.

Layer 1: Content Architecture (Format System)

Creative experimentation does not scale. To support an enterprise catalog of thousands of SKUs, retailers must move from “artisanal” video creation to a Format System that aligns specific video types with customer intent and funnel stages.

Format-to-Metric Mapping

Format selection should not be arbitrary; it must be mapped to the specific psychological barrier the customer faces at that stage of the journey.

| Format Type | Strategic Objective | Primary KPI | Secondary KPI |

| Product Demo | Visualize Utility: Showcases features, textures, and mechanics in action to prove value. | ATC Rate (Add-to-Cart): Direct correlation between viewing and cart addition. | PDP Time: Retention past the 3-second mark. |

| Install / How-To | Reduce Friction: Acts as a “digital project partner” to bridge the skills gap and prove feasibility. | Conversion Rate: Direct sales lift from the video player. | Returns Reduction: Ensures customers buy the right part and install it correctly. |

| Before/After | Inspire: Uses the “challenge and relief” narrative arc to visualize the outcome. | Engagement: Shares and saves. | Assisted Revenue: Multi-touch attribution crediting early-funnel inspiration. |

| Comparison | Support Decision: Side-by-side analysis (e.g., Galaxy S21 vs. S21 Ultra) to reduce decision fatigue. | Consideration Lift: Moving from browse to cart. | SKU Switch Rate: Upselling to higher-margin models. |

| Project Bundle | Increase AOV: “Shop the Look” or “Shop the Project” functionality that groups complementary items. | Attachment Rate: Items per basket. | Revenue per Session: Total value extracted per visit. |

Coverage Strategy (Capital Allocation Model)

This is the Tiered Production Matrix introduced in the operating model: Tier 1 buying guides, Tier 2 expert demos, Tier 3 rapid/AI coverage, allocated by margin and friction density.

| SKU Tier | % of Catalog | Production Model | Investment Objective |

| Tier 1 (Hero) | 5–10% | Studio-Grade: Professionally produced 90-second buying guides for high-margin, complex categories (e.g., appliances). | Revenue Acceleration: Justified by high AOV and long consideration cycles. |

| Tier 2 (Core) | 20–40% | Expert Demos: Agile content featuring internal SMEs (e.g., “Orange Apron” associates) focusing on specific feature demonstrations. | Conversion Lift: Bridging the “confidence gap” for mid-tier products. |

| Tier 3 (Long Tail) | Remaining | Rapid / AI-Assisted: “Point-and-shoot” mobile video or AI-generated clips (using tools like Tolstoy’s AI Studio) to ensure baseline visual coverage. | Baseline Coverage: Eliminating “dead” product pages that lack motion. |

- Strategic KPI: Coverage Ratio, What percentage of revenue-driving SKUs have video support?

Layer 2: Creator Supply Chain (Distributed Expertise Infrastructure)

Influencer campaigns are episodic and often vanish after the contract ends. Enterprise creator networks are continuous, treating creators as “infrastructure” that provides an always-on stream of assets for the O&O (Owned and Operated) site.

Creator Role Architecture

In high-consideration categories like DIY, credibility comes from “doing,” not just “styling”.

| Creator Type | Trust Driver | Strategic Use Case |

| Internal SMEs | Store Authority: Employees (e.g., Home Depot’s “Orange Apron” experts) provide technical accuracy and humanize the brand. | Installation Content: Solving specific technical hurdles that cause returns. |

| Contractors / Pros | Skill Validation: Professional tradespeople who stress-test tools in real jobsite conditions. | B2B Credibility: Proving durability and performance to professional buyers. |

| Lifestyle DIYers | Relatability: Everyday users who demonstrate that a project is achievable for the novice. | Discovery & Inspiration: “Before & After” transformations. |

| B2B Specialists | Commercial Credibility: Experts in specific trades (plumbing, electrical). | High-Margin Projects: Complex system sales (e.g., HVAC, smart home). |

Contracts must include: To operationalize this supply chain, contracts must move beyond simple posting fees to asset ownership.

- Whitelisting Rights: Allowing the brand to run ads under the creator’s handle to maintain authenticity while controlling targeting.

- Perpetual O&O Usage: The right to use the video on the retailer’s product page indefinitely, preventing “content decay” when a campaign ends.

- Paid Amplification: Clauses allowing the brand to boost high-performing posts with paid media.

- Category Exclusivity: Preventing creators from promoting direct competitors for a set period (e.g., 30-90 days).

- Repurposing Permissions: Explicit rights to edit, cut down, or remix the content for other channels (e.g., turning a YouTube video into a TikTok ad).

Creators are production partners, not rented audiences.

Layer 3: Catalog & Product Integration

Shoppability collapses without data alignment. The video player must act as a seamless extension of the ecommerce backend to prevent customer frustration.

Required Data Fields & Player Behaviors (Technical Specification)

For shoppable video to function as commerce infrastructure, the player must surface and sync specific structured fields.

Required Player Field Mapping

For the video player to behave like a first-class ecommerce surface, it must consume and render structured data from core commerce systems. These fields are not “nice to have” metadata, they are the minimum inputs required to prevent pricing errors, variant mismatches, and compatibility confusion.

The table below outlines the baseline field mapping necessary for enterprise-grade shoppability.

| Field Name | Source System | Purpose |

| sku_id | PIM | Unique SKU reference |

| variant_id | PIM | Correct size/finish mapping |

| price_cents | ERP / Pricing API | Real-time price display |

| inventory_qty | Inventory API | OOS logic |

| inventory_timestamp | Inventory API | Freshness validation |

| dimensions_cm | PIM | Fit validation |

| power_spec | PIM | Voltage / performance validation |

| installation_required_flag | PIM | Determines instructional overlays |

| canonical_pdp_url | Ecommerce Platform | SEO-safe fallback |

Required Failure-Mode Behaviors

Even with proper field mapping, enterprise systems will encounter edge cases: stale inventory feeds, variant mismatches, warehouse discrepancies, and pricing delays.

What separates a marketing widget from commerce infrastructure is how the player behaves when something goes wrong. The behaviors below define the minimum UX safeguards required to protect conversion and trust at scale.

| Condition | Required UX Behavior |

| inventory_qty = 0 | Hide “Add to Cart” + show “Notify Me” |

| inventory timestamp > SLA threshold | Suppress price display until refreshed |

| variant mismatch | Default to specific variant SKU (not parent SKU) |

| multi-warehouse SKU | Surface nearest-store pickup option |

These behaviors prevent trust erosion at scale.

Required Integrations

The technical stack must marry the creative asset with hard data.

| System | Purpose | Operational Benefit |

| PIM (Product Info Mgmt) | Accurate SKU Data: Provides structured metadata (pricing, specs). | Ensures the video doesn’t promise features the product lacks. |

| DAM (Digital Asset Mgmt) | Asset Organization: Manages video versions, rights expirations, and compliance. | Streamlines creative workflows and brand safety. |

| Ecommerce Platform | PDP + Cart Sync: Syncs cart logic and checkout flow (e.g., Shopify, Salesforce). | Enables “Add to Cart” directly within the video overlay. |

| Inventory API | OOS Handling: Uses “delta feeds” to update stock status instantly. | Automatically hides shop links for out-of-stock items. |

| Media Feeds | Retargeting: Pushes assets to ad networks and social commerce shops. | Ensures consistent pricing across all endpoints. |

Failure Points to Eliminate

Operational risks in shoppable video can directly impact revenue and brand trust.

| Risk | Business Consequence | Operational Solution |

| Out-of-Stock Tagging | Trust Erosion: Users click a product only to find it unavailable, leading to bounce. | Real-Time Sync: Automated removal of “Add to Cart” buttons when inventory hits zero. |

| Incorrect Variants | Returns: Linking to the wrong size or voltage causes “item not as described” returns. | SKU-Level Metadata: Tagging specific variants rather than generic parent SKUs. |

| Static Pricing | Margin Leakage: Video displays an old promo price while the cart shows full price. | Dynamic Overlays: Price is pulled via API at the moment of view. |

| Social-Only Execution | Lost First-Party Data: Relying solely on TikTok/IG means losing visibility into viewer intent. | Onsite Embedding: Converts video into owned infrastructure, capturing granular engagement data. |

Onsite embedding converts video into owned infrastructure.

Layer 4: Distribution Orchestration

Distribution must align with buyer intent. The same video asset plays different roles depending on where the user encounters it.

| Channel | Strategic Role |

| TikTok / Reels | Inspire: Short, vertical video serves as a “lead magnet,” sparking the initial idea. |

| YouTube | Educate: Long-form tutorials build trust and answer detailed technical questions. |

| Onsite PDP | Convert: Embedded players drive the final purchase decision by visualizing utility. |

| Re-engage: GIFs or video embeds in email flows (e.g., abandoned cart) bring users back to the purchase. | |

| Paid Media | Scale Incremental Exposure: Whitelisted creator ads target lookalike audiences to drive new traffic. |

Repurposing Framework

Enterprise scale requires a “create once, distribute everywhere” mentality.

- Livestream → Cutdown → PDP Embed: A 30-minute live shopping event is sliced into 60-second highlight clips for product pages.

- Long Demo → Paid Social → Retargeting: A detailed 5-minute review is edited into a 15-second hook for social ads.

- Social UGC → Onsite Credibility Module: High-performing customer reviews from social are pulled into a “Wall of Love” or carousel on the website.

Assume multi-surface deployment at production.

Layer 5: Measurement & Incrementality

Shoppable video in Home + DIY cannot be evaluated using standard channel metrics alone. High-AOV projects often involve multiple sessions, in-store visits, and delayed purchases. A customer may watch an installation walkthrough in March and purchase in April, or finalize materials in-store after researching online.

Because of this latency, last-click attribution systematically undervalues video.

Enterprise programs must shift from media reporting (“views, clicks, CTR”) to causal measurement frameworks that isolate incremental revenue, conversion acceleration, and risk reduction. The goal is not to prove engagement, it is to prove financial impact.

Measurement Stack

No single metric captures the full value of shoppable video in high-consideration categories. Instead, retailers need a layered measurement stack that captures influence, incrementality, purchase behavior changes, and operational risk reduction.

The metrics below work together to determine whether video is functioning as commerce infrastructure, not just content.

| Metric | Strategic Insight |

| View-Through Revenue | Influence Capture: Credits the video for sales that occur days later, recognizing long research cycles. |

| iROAS (Incremental ROAS) | True Incremental Lift: Measures revenue that would not have occurred without the video exposure. |

| ROMO (Return on Marketing Objective) | Long-Term Impact: Aligns media investment with strategic goals like brand awareness and customer retention. |

| Time-to-Purchase | Confidence Acceleration: Measures if video shortens the cycle from discovery to conversion. |

| AOV Lift | Bundle Success: Tracks if video viewers buy more items (e.g., project bundles) than non-viewers. |

| Return Rate Reduction | Risk Mitigation: Confirms if video education reduces “item not as described” returns. |

Incrementality Testing Models

Incrementality cannot be assumed, it must be proven.

Without controlled testing, shoppable video risks taking credit for demand that would have converted organically. Enterprise retailers should implement structured test-and-control frameworks that isolate the true contribution of video exposure to sales, AOV, and return-rate suppression.

The models below represent the minimum scientific approaches required to validate causal lift at scale.

| Model | Application |

| Geo Holdout | Category Lift: Running shoppable video in specific regions while “holding out” others to measure total sales lift. |

| Audience Split | Paid Exposure Impact: Randomly assigning users to “test” (see video) and “control” (do not see video) groups. |

| PDP A/B | Onsite Embed Lift: Testing product pages with video vs. static images to measure conversion rate differences. |

| Creator Cohort | Expertise Effectiveness: Comparing the sales impact of different creator types (e.g., Pro vs. DIYer). |

The Roadmap: From Pilot to Program

Scaling shoppable video from a marketing experiment to a core commerce function requires a phased operational maturity model. This roadmap moves the organization from proving value on a small scale to integrating video as “always-on” infrastructure.

| Phase | Strategic Focus | Operational Action Items | Primary KPI |

| Phase 1: Controlled Pilot | Proof of Concept | • Select High-Friction Categories: Target SKUs with high return rates or installation complexity (e.g., smart home, plumbing) to prove utility. • Manual Tagging: Use a basic player to manually tag 50-100 SKUs to test the “Add to Cart” functionality without full integration. • Video Pre-Check: Utilize tools to scan for violation risks before publishing. | PDP ATC Lift: Measuring the conversion difference between pages with vs. without video. |

| Phase 2: Creator Expansion | Volume & Coverage | • Tiered Production: Adopt a “Tier 1/2/3” model (Studio / Expert / AI) to cost-effectively scale video coverage across thousands of SKUs. • Creator Pods: Onboard “Internal SMEs” and “Pros” alongside influencers to diversify content types (demos vs. tutorials). • Automated Distribution: Push content to product pages and social channels simultaneously. | Coverage Ratio: Percentage of revenue-driving SKUs with shoppable video support. |

| Phase 3: Full Integration | Data Integrity | • Server-to-Server Sync: Connect the video player to the PIM/ERP via API to enable “delta feeds.” This ensures pricing and inventory update in real-time. • AI Auto-Tagging: Deploy computer vision to automatically identify and tag products in video frames, removing manual labor. • In-Video Checkout: Enable “Add to Cart” directly within the video player to reduce friction. | Tag Accuracy & Error Rate: Frequency of out-of-stock items appearing as shoppable. |

| Phase 4: Optimization | Causality & Profit | • Incrementality Testing: Run “holdout” tests (geo-lift or audience split) to prove video is generating new revenue, not just claiming credit for organic sales. • ROMO Implementation: Shift reporting to “Return on Marketing Objective” to capture long-term brand impact beyond immediate last-click sales. | iROAS: Incremental Return on Ad Spend (isolating true lift). |

Final Perspective: From Campaign to Infrastructure

Shoppable video in Home + DIY cannot remain a social experiment or a seasonal campaign. To survive in a market defined by the “Confidence Gap,” retailers must treat video as operational commerce infrastructure.

When embedded correctly, it creates four enterprise-grade value layers:

- Catalog-Connected Commerce Interface: The player stays consistent with the cart, correct SKU/variant, current price, current inventory, so video can drive transactions without breaking trust.

- Distributed Expertise Infrastructure: It digitizes the “store associate,” scaling the knowledge of internal experts and professional contractors to millions of digital sessions simultaneously.

- Conversion Surface: It compresses the funnel by allowing transactions to occur at the point of inspiration, transforming “watch time” directly into revenue without a redirect.

- Incrementality-Tested Revenue Engine: It moves beyond vanity metrics (views) to measure financial causality, proving that video is not just engaging users, but actively altering their purchase behavior.

Retailers that treat video this way will not simply increase engagement, they will systematically reduce friction across high-consideration categories and convert confidence into revenue at scale.

About Noah Atwood

MORE TO EXPLORE

Related Insights

More advice and inspiration from our blog

Top 6 Large Scale Ecommerce Digital Marketing Agencies (Deep Research)

Ecommerce marketing is entering a new era where scale isn’t defined...

Patrick Algrim| February 12, 2026

Why Some Super Bowl LX Ads Worked (and Others Didn’t)

The Super Bowl LX remains one of the few moments where...

Top 6 Home Improvement Retailer Digital Marketing Agencies (2026)

Home improvement retail does not follow standard digital marketing playbooks. It...

Tony Salerno| February 09, 2026