Home / Blog / Top 5 SaaS Efforts That Won’t Waste Budget in 2026

Top 5 SaaS Efforts That Won’t Waste Budget in 2026

Published: December 15, 2025

Share on LinkedIn Share on Twitter Share on Facebook Click to print Click to copy url

Contents Overview

Forrester reports that 98% of B2B leads never become customers.

It’s a reminder that most demand-gen programs still produce volume instead of revenue.

SaaS teams aren’t being asked to cut spend, they’re being asked to prove that every funded motion influences pipeline, win rate, and CAC payback.

Those metrics now determine budget more than MQL counts ever did. And that shift means something important: 2026 demand gen isn’t about doing more. It’s about concentrating spend on the few motions that consistently deliver qualified pipeline.

This article covers the efforts that deserve investment because they show real commercial impact, how to judge what’s worth funding, and where waste actually occurs inside SaaS acquisition paths.

Trends Shaping Demand Gen ROI in 2026

SaaS buying behavior has changed faster than most acquisition models. The signals that matter most—intent, fit, authority, and clarity—now form earlier, often before a visitor ever reaches a product page.

That shift affects how pipeline is created, how offers convert, and how teams judge whether spend is working.

Several patterns now shape how revenue is won:

Decision-making is front-loaded.

Studies show that 60–80% of evaluation happens before a buyer talks to sales. More research moves into channels teams don’t control: AI summaries, peer threads, LinkedIn posts, comparison pages, customer reviews, and internal conversations. The funnel still exists, but the influence points shifted upstream.

AI search reshapes how buyers validate solutions.

Evaluation is increasingly distributed across ChatGPT, Gemini, Perplexity, and platform-generated summaries. Buyers reach your site with narrower questions and clearer expectations, which raises the bar for relevance and makes “traffic growth” a weaker indicator of demand.

*Download Your SaaS AI Performance Review Checklist here

Demo volume keeps rising while demo quality declines.

As demo-first strategies expand, quality trends the opposite way. More people click “demo” out of curiosity than actual readiness, and sales teams carry the burden. That produces bloated pipelines and slower progression.

Paid social costs continue to climb.

CPCs on LinkedIn and Meta keep rising while SQL conversion rates remain flat or fall across SaaS categories. Saturation isn’t the core issue, message relevance and offer clarity are. Without that alignment, paid social becomes one of the fastest ways to burn budget.

Executives want revenue clarity, not channel growth.

Awareness spend is now challenged unless it shows movement in pipeline velocity, win rate, or retention signals. Teams need explanations that connect an initiative to a measurable commercial impact, or funding becomes discretionary.

Why Efficiency Is the Real SaaS Growth Lever

As we stated earlier, SaaS teams aren’t necessarily being asked to cut budget. They’re being asked to prove that every funded motion influences revenue. Efficiency matters because it directly affects how much room a team has to reinvest.

When qualification improves win rate and cycles move faster, the same budget produces more pipeline.

A few patterns underline this shift:

- Lead volume means little without intent. Lead growth doesn’t help when intent is low or offers are unclear. Weak qualification slows deals and raises cost per opportunity.

- High-intent channels outperform by default. Search and comparison paths keep generating solid pipeline, but only when targeting and messaging reflect real buying language.

- Alignment multiplies results. When search, paid, and content support the same narrative, performance lifts. When each runs separately, spend fragments.

- Revenue signals compound. Better qualification improves win rate. Higher win rate improves CAC payback. Stronger payback creates more budget flexibility.

Efficiency isn’t about doing less. It’s about removing motions that were never going to create revenue and funding the ones that repeatedly do.

And if efficiency is the real lever, then the first step is knowing which metrics actually signal it:

#1: Benchmarks That Decide What Gets Funded

Lead volume is still a common way to judge channels, but it rarely reflects revenue impact.

The metrics that actually decide whether a motion deserves budget are tied to efficiency and progression. If something doesn’t improve CAC payback, win rate, or pipeline velocity, it raises cost without adding value.

A few benchmarks separate high-value motions from waste:

- CAC payback: Healthy ranges fall between 12–24 months depending on ACV. Shortening this unlocks more reinvestment.

- Pipeline-to-revenue conversion: Strong teams sit around 25–40%. Low conversion usually signals qualification issues, not “top-funnel weaknesses.”

- Win rate: Efficient programs lift SQL → Closed-Won rates into the 20–35% range, higher for ICP inbound.

- Retention signals: NRR (Net Revenue Retention) above 100% and GRR (Gross Revenue Retention) above 85% confirm that you’re attracting buyers who stick.

- Pipeline velocity: Faster movement through stages reflects clarity in messaging, targeting, and offer design.

- Pipeline ROAS: Revenue-producing channels often return $3–$12 in qualified pipeline for every $1 spent.

#2: Spend Where Revenue Actually Comes From

Most SaaS pipelines rely on a small group of channels that consistently drive qualified demand. Waste happens when budget is split across too many motions. The answer usually isn’t new channels, it’s sharper focus on the ones that already work.

Key areas that continue to drive pipeline:

- High-intent paid search: Still the strongest capture channel when negatives, match types, and ICP filters are handled with precision. Most waste comes from broad-match sprawl and irrelevant queries.

- LinkedIn demand programs: Performance lifts when messaging builds trust and addresses buying concerns. Optimizing for MQL volume weakens quality and inflates cost.

- Intent-led SEO: Comparison pages, ROI explainers, alternatives, risks, and implementation content produce far more pipeline than generic TOFU pieces.

- ABM motions: Effective when aimed at buying groups, not isolated leads. Coordinated outreach across ads, SDR, and nurture reduces cycle time.

- Partner ecosystems: Often produce the highest-fit opportunities with the lowest acquisition cost.

The goal isn’t to expand channel count. It’s to double down where revenue is consistently created and remove spend from motions that only produce traffic or low-fit leads.

#3: Measure Demand Using Revenue Evidence, Not Traffic

But wouldn’t traffic be considered “evidence?” No, not really.

Traffic shows movement, not intent. A session spike doesn’t tell you whether buyers understood the offer, whether the right roles engaged, or whether anyone is closer to becoming an opportunity.

Real evidence comes from signals tied to qualification and progression:

- Multi-touch attribution shows contribution.

- Self-reported attribution shows causality.

- Role-based engagement shows who actually cares.

- Pipeline velocity shows whether messaging is reducing friction.

- Win rate shows fit and clarity.

Teams that adopt revenue-based measurement tend to reallocate spend faster because they’re watching commercial outcomes, not consumption. Channels with low CPL often underperform in SQL quality, while content with modest traffic can produce disproportionate revenue when it answers high-intent questions.

Traffic doesn’t reveal any of this. Revenue signals do.

#4: Frameworks That Concentrate Spend (Instead of Adding More)

Search moves one direction, paid social another, content follows its own roadmap, and sales messaging drifts behind all of it. When channels don’t reinforce each other, performance stays flat no matter how much money goes in.

The fix is concentration.

Buyers jump between search, AI answers, comparisons, LinkedIn, and peer input before they ever convert. Spend should match the moments that shape evaluation, not every touchpoint.

Concentration comes from tightening efforts around:

- the questions buyers ask repeatedly.

- the proof they look for.

- the pages and offers that influence qualification.

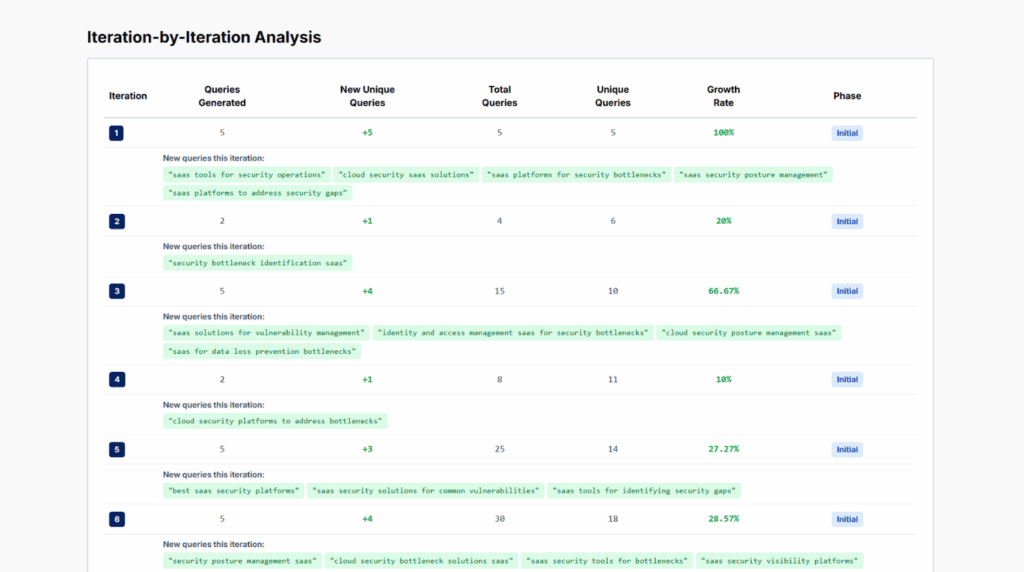

This is where E.C.H.O. and Barracuda, our Agentic AI, work together:

Barracuda surfaces the themes, entities, and patterns that shape demand across search and AI systems.

E.C.H.O. (Explore → Correlate → Harness → Optimize) uses those insights to align search, paid, social, and nurture into one integrated motion instead of ten scattered campaigns.

What you can see here is how Barracuda and E.C.H.O. work together:

- Barracuda expands one real buyer problem (SaaS platforms for security bottlenecks) into the full set of questions and topics shaping evaluation across search and AI systems.

- Those queries cluster into clear themes around security posture, compliance, visibility, and bottlenecks.

- That insight shows where intent actually forms, not just where traffic appears.

- E.C.H.O. uses those patterns to align search, paid, social, and nurture around the same buyer concerns instead of running separate campaigns.

#5: Design Offers That Qualify Buyers Before the Demo

The “Book a Demo” button has become SaaS’s universal CTA. And it’s causing more harm than teams realize.

Demo volume keeps rising while demo quality drops. Buyers schedule out of curiosity, not readiness, and sales teams absorb the fallout.

A better approach is giving buyers steps that test readiness:

- ROI calculators

- Guided previews

- 2–3 minute product walk-throughs

- Implementation checklists

These formats attract evaluators, not browsers. When teams shift from “book a demo” to “help buyers decide,” demo-to-customer rates rise, SQL quality tightens, and pipeline ROAS becomes easier to defend.

A 90-Day Efficient Spend Plan

Month 1: Diagnose What’s Working (and What Isn’t)

Start by pulling a clear read on where qualified pipeline actually came from in the past 6–12 months. Look at SQL rate, pipeline velocity, win rate, and CAC payback impact for each channel or campaign.

Identify patterns:

- Which motions consistently created SQLs that converted?

- Which ones generated “leads” with no conversion?

- Where did messaging or offers attract the wrong buyers?

- What offers or resources did these converted users touch?

Map the buyer path using analytics, call themes, attribution, and SRA. This gives you the real picture of how deals start and where intent shows up.

Month 2: Reallocate Toward High-Intent + High-Evidence Motions

Shift budget into the channels tied to revenue — not traffic. Consolidate campaigns into one integrated motion using tools like Barracuda + E.C.H.O. so search, paid, social, and nurture reinforce the same message.

Refresh offers to emphasize qualification steps instead of demo requests, and update messaging around ROI, risks, comparisons, and implementation questions buyers repeatedly ask.

Build one dashboard that reports pipeline created, deal acceleration, win rate lift, and wasted spend.

Month 3: Optimize Around Revenue Signals

Review pipeline ROAS, demo-to-customer rate, velocity, and SQL quality weekly. Let these signals guide optimizations, not clicks or CPL.

Using an Agentic AI tool like E.C.H.O. to refine how work gets executed across channels:

- Explore: confirm how buyers are searching and validating during this cycle.

- Correlate: connect content, creative, and performance signals to what buyers actually respond to.

- Harness: run campaigns and experiments that match those patterns across search, paid, social, and nurture.

- Optimize: feed results back into the system so each cycle reduces waste and strengthens what works.

Only expand spend when it improves CAC payback, win rate, or influence on pipeline.

Final Thoughts

SaaS demand gen isn’t losing effectiveness — it’s outgrowing the tactics built for lead volume. The next wave of growth comes from clarity, qualification, and integrated programs that reflect how buyers actually decide.

When spend concentrates on the motions that consistently produce SQLs, everything downstream improves. CAC payback tightens. Win rates rise. Budget becomes easier to defend.

If you’re ready to tighten performance and reduce waste, schedule a walkthrough with our SaaS experts to see how E.C.H.O. and Barracuda can support your pipeline.

About Kellyann Doyle

MORE TO EXPLORE

Related Insights

More advice and inspiration from our blog

SaaS Marketing Metrics for 2026: Revenue-Centric KPIs, AI Signals, and Efficient Growth

Clicks and MQLs don’t signal buying intent. This guide breaks down...

How Home Goods Buyers Decide in 2026 Across Social, Search, AI, and Your Website

How home goods buyers discover, evaluate, and decide in 2026 across...

Kimberly Anderson-Mutch| December 19, 2025

Common Ways SaaS Teams Create Bad Leads Without Realizing It

Uncover the hidden ways SaaS teams generate bad leads, from misaligned...

Kimberly Anderson-Mutch| December 16, 2025