Home / Blog / How Home Goods Buyers Decide in 2026 Across Social, Search, AI, and Your Website

How Home Goods Buyers Decide in 2026 Across Social, Search, AI, and Your Website

Published: December 19, 2025

Share on LinkedIn Share on Twitter Share on Facebook Click to print Click to copy url

Contents Overview

A buyer sees a console table in a TikTok haul on a Sunday night. On Monday, they open their laptop during lunch and start searching. They jump between product pages, zoom into photos, compare dimensions, skim reviews, check return policies, and ask an AI tool whether MDF versus solid wood actually matters for their space.

They don’t buy. They tell themselves they’ll come back.

Most never do.

That moment captures how home goods buying works in 2026. Not impulsive, not linear, and not confined to a single channel.

Buyers move fluidly across social platforms like TikTok, Instagram, and YouTube; organic Google results; paid ads; brand websites; and AI tools like ChatGPT and Gemini to reduce uncertainty before committing. Nearly 50% of U.S. consumers say social media is now their primary way to discover new brands, reinforcing how often the journey starts outside a brand’s site.

The brands that win remove doubt wherever it appears. The brands that lose often break trust at the website moment.

This article breaks down how buyers actually discover, evaluate, and decide today, and what that means for home goods brands selling online.

The Core Pain Points Home Goods Buyers Face Online

Even in a digital-first shopping experience, home goods buyers run into the same friction again and again:

- Incomplete product information or unclear specifications.

- Inconsistent quality signals across similar products.

- Price skepticism driven by vague claims or inflated comparisons.

- High friction around shipping costs, delivery timelines, and returns.

- Urgency without enough clarity to decide confidently.

These are not edge cases. They’re structural issues tied to complex products, large-item logistics, and unclear value communication online.

This friction matters because 81% of online shoppers research before buying, and 60% start that research on a search engine before visiting a product page, meaning confusion compounds quickly if clarity breaks at any step.

Buyers respond by building their own validation systems across social content, organic search, AI tools, and brand websites.

Understanding that system matters more than optimizing any single channel.

Discovery: How Buyers Get on the Radar

Discovery is no longer campaign-driven. It’s cadence-driven.

Buyers don’t wait for promotions or emails. They notice patterns: creator hauls, trending styles, recurring ads, and peer recommendations. Social content sparks awareness, but it rarely closes the loop on its own.

A rug shows up in an Instagram Reel. A YouTube creator mentions a similar style. A friend drops a screenshot into a group chat saying, “This feels like your place.” Interest is triggered, but certainty is not.

That behavior aligns with broader trends. Nearly 45% of consumers report purchasing directly from social platforms, but far more use social as a starting point before moving elsewhere to evaluate

Most buyers click through to the brand’s website next, even if they don’t plan to buy immediately. They want to understand price, materials, delivery timelines, and return terms before investing more effort.

Common discovery inputs include:

- TikTok and Instagram hauls that surface styles or categories

- YouTube walkthroughs that show scale and context

- Group chats and peer recommendations

- Repeat site visits sparked by ads or social reminders

Social creates mental availability. The website becomes the next stop for grounding that interest in reality.

Evaluation: Buyers Compare Signals Across Search, Social, AI, and the Website

At this stage, buyers are trying to answer one question:

Do I get this brand?

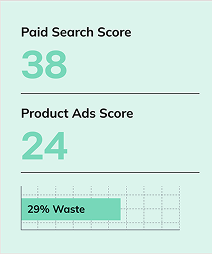

Whether they’re scrolling at home or comparing tabs during a break, buyers aren’t thinking about channels. They’re thinking about risk. They search the brand name, scan reviews, glance at Reddit, and increasingly ask an AI tool to summarize whether the quality and price make sense.

This shift is measurable. 56% of consumers say they plan to use AI tools to compare prices or find deals, and 47% plan to use AI to summarize reviews before buying.

For eCommerce brands, this evaluation often happens on the product detail page. Buyers scan images for scale, read reviews for durability, check delivery timelines, and look for return clarity. If the PDP answers those questions clearly, confidence builds. If it doesn’t, buyers leave and continue their search elsewhere.

AI tools compress this entire step even further. Nearly 60% of Americans now use generative AI to assist with online shopping, most often for product research and comparisons.

If AI explanations contradict what appears on the website, trust erodes quickly.

Buyers are not comparing products line by line. They’re comparing signals. When claims, proof, and policies don’t line up across social, search, AI, and the website, hesitation follows.

Consideration: Is This Right for Me?

Once buyers understand the brand, the next question is personal:

Will this actually work for me?

This is where many purchases stall. Buyers already like the idea of the product. Now they’re testing fit, effort, and downside.

They:

- Compare dimensions to their space.

- Review materials and care instructions on the website.

- Look for confirmation from people with similar needs.

- Evaluate delivery fees, timelines, and return windows.

Phones are constant companions here. Buyers compare product images against their room, toggle between tabs, and revisit the website multiple times. When answers are missing or buried, momentum slows, even if the product itself is appealing.

Decision: When Price Becomes the Objection

Price resistance is rarely about the number on the tag.

A low-stock message appears on the page. The buyer hesitates anyway. They picture the return, the shipping fees, the time it would take to undo the decision. They scroll back to the policies section to recheck the fine print.

The discount isn’t the problem. The uncertainty is.

Buyers are weighing:

- Quality versus effort

- Cost versus risk

- Price versus the hassle of returning a large item

This is the moment where “Is this worth the price?” becomes the deciding factor. Whether the final purchase happens immediately or days later, the decision is usually made on the website, where buyers reconcile value, logistics, and downside.

Urgency can push a decision. Clarity keeps it.

Post-Purchase: The Sale Isn’t the End

Home goods buyers keep evaluating after checkout.

They revisit the website for assembly instructions, care guidance, and reassurance they made the right choice. They reread reviews, compare their experience to expectations, and decide whether to recommend or return.

This stage influences returns, reviews, and word-of-mouth far more than most brands expect. When post-purchase content is easy to find, confidence sticks. When it isn’t, doubt creeps in.

The Cross-Channel Buying Loop in 2026

Because no single channel answers every question, buyers create their own loop:

- Social sparks interest.

- Organic search validates claims.

- AI tools summarize and compare.

- Paid ads reinforce or contradict.

- The brand website confirms value, fit, and risk.

- Checkout or delivery completes the purchase.

Buyers experience this as one system. Brands often manage it as many.

When those pieces contradict each other, friction shows up even if traffic looks healthy.

What This Means for Home Goods Brands

Winning in 2026 is not about choosing the right channel. It’s about removing doubt wherever buyers encounter you, especially on your website.

Brands that perform well:

- Show up consistently across discovery surfaces

- Explain value clearly and repeatedly

- Reduce risk through clarity, not urgency

- Align social, organic, paid, AI visibility, and eCommerce experience

Buyers are already connecting the dots. The brands that help them do it faster earn the sale, and keep it.

Want to talk through what this looks like for your site? Reach out and we’ll take a look at where buyer confidence breaks.

About Kimberly Anderson-Mutch

MORE TO EXPLORE

Related Insights

More advice and inspiration from our blog

What Brands Miss When They Treat GEO Like SEO

Treating GEO as a replacement for SEO breaks generative visibility. Learn...

Matt Parker| January 21, 2026

ChatGPT Ads Are Coming And They’re Competing for Performance Budgets

ChatGPT is introducing ads and entering the performance arena. Here’s what...

Kimberly Anderson-Mutch| January 20, 2026

AI Search Is Reshaping How Brands Win in 2026

Learn how AI search is changing SEO in 2026. See what...

Josh Kimble| December 11, 2025